When I began my undergraduate studies in psychology at the University of New Mexico, I never imagined how far this field would take me—not just academically, but in shaping my professional and personal journey. Graduating summa cum laude in 2020 was a proud milestone, but it was the experiences along the way, especially in addiction research, that truly defined my trajectory.

Addiction research, in particular, opened my eyes to the resilience of the human mind and the importance of understanding behavior. Little did I know at the time, the lessons I learned in the lab would later inform my approach to an entirely different field: trading.

Diving Deep into Addiction Research

As a research assistant in Mateo Lab, I worked on studying the psychological and biological foundations of addiction. It was an immersive and rigorous experience that required meticulous attention to detail, collaboration, and a deep understanding of human behavior.

Our findings, later published in a respected research journal, explored patterns of addiction and recovery. Analyzing these patterns was a powerful reminder of how habits, decision-making processes, and external pressures influence behavior. While this work had a profound impact on my understanding of psychology, it also planted the seed of curiosity about human behavior in other high-stakes environments.

I often reflect on how addiction research emphasized the importance of emotional regulation and decision-making under stress—skills that have proved invaluable in the fast-paced world of trading.

Transitioning to Trading: A New Challenge

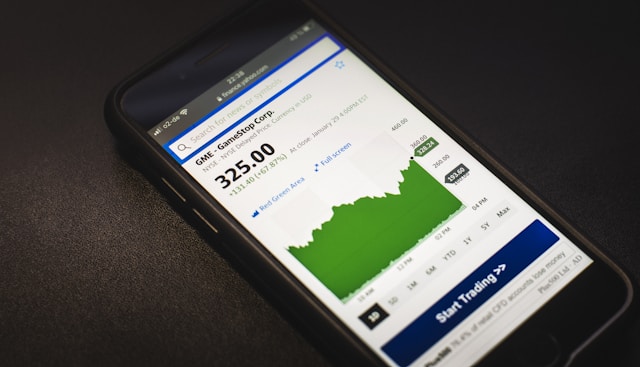

After completing my degree, I sought new challenges that allowed me to apply my analytical skills and behavioral insights in a different context. Trading emerged as a compelling avenue. The stock market, with its complex interplay of data, psychology, and strategy, was both daunting and fascinating.

At first glance, trading might seem worlds apart from addiction research, but the two share surprising parallels. In both fields, understanding patterns, managing risk, and maintaining discipline are essential. Trading is as much about psychology as it is about numbers. Emotions such as fear, greed, and overconfidence can cloud judgment, leading to impulsive decisions—a phenomenon I had seen repeatedly in my research on addiction.

My background in psychology gave me an edge in navigating these challenges. By recognizing cognitive biases and staying grounded in data-driven decisions, I developed strategies to manage risks and seize opportunities effectively.

Insights from Addiction Research Applied to Trading

Several key insights from my time in the lab have directly influenced my approach to trading:

- The Power of Habits:

Addiction research underscores how habits, both good and bad, shape behavior. In trading, consistent habits like daily analysis, journaling trades, and setting clear goals are crucial for long-term success. Establishing positive routines reduces the risk of emotional or impulsive decisions. - Emotional Regulation Under Pressure:

Addiction recovery often hinges on an individual’s ability to manage stress and emotions. Similarly, successful trading requires a calm, focused mindset, especially during volatile market conditions. When the market becomes unpredictable, my ability to stay composed helps me make rational choices instead of reacting impulsively. - Understanding Cognitive Biases:

Addiction research highlights how biases distort decision-making. In trading, recognizing these biases—such as loss aversion or confirmation bias—has helped me avoid common pitfalls. This self-awareness allows me to adjust strategies and remain objective. - The Importance of Data Analysis:

Just as we relied on data to understand patterns in addiction, I now rely on technical and fundamental analysis to identify trends in the market. My research experience taught me to approach data critically and make decisions based on evidence rather than intuition.

Balancing Professional and Personal Growth

Trading is not just a career for me—it’s a personal growth journey. It has challenged me to develop discipline, resilience, and adaptability, traits I first honed during my academic career.

Outside of trading, I find balance through hobbies like working out, hiking, and gaming. These activities keep me grounded and provide a sense of fulfillment that extends beyond financial success. Personal growth has always been a priority for me, and I strive to continuously improve in all areas of life.

One of the most rewarding aspects of this journey has been connecting with others who share similar passions. Building a network of like-minded individuals—whether through psychology, trading, or personal interests—has enriched my perspective and inspired me to aim higher.

Lessons for Aspiring Traders

For anyone considering a transition into trading, here are a few key lessons I’ve learned along the way:

- Invest in Education:

Just as my success in psychology required rigorous study, trading demands a strong foundation of knowledge. Take the time to learn about market dynamics, strategies, and tools before diving in. - Embrace a Growth Mindset:

Mistakes are inevitable, but they’re also opportunities for growth. Reflect on what went wrong, adapt your approach, and keep moving forward. - Control Your Emotions:

Emotional decisions can lead to significant losses. Develop strategies to stay calm under pressure, whether through mindfulness, journaling, or setting clear rules for yourself. - Stay Disciplined:

Consistency is key. Establish routines that keep you focused and committed, even during challenging times. - Leverage Your Strengths:

If you come from a different field, look for ways to apply your existing skills to trading. For me, psychology provided valuable insights into behavior and decision-making that have proven indispensable.

Final Thoughts

My journey from addiction research to trading has been anything but conventional, yet the lessons I’ve learned along the way have been transformative. Both fields have taught me the value of discipline, resilience, and self-awareness.

Trading has not only challenged me professionally but has also become a catalyst for personal growth. It has pushed me to think critically, manage my emotions, and continuously strive for improvement.

If there’s one piece of advice I’d offer to anyone exploring new opportunities, it’s this: don’t be afraid to draw connections between seemingly unrelated experiences. Whether it’s the principles of psychology or the patterns of the stock market, every lesson can be a stepping stone toward success.

As I look ahead, I remain excited about the possibilities that lie ahead—both in trading and in life. The journey may be unpredictable, but with the right mindset and a willingness to learn, the possibilities are endless.